Foreign Vietnamese are spending big on apartments and land in Vietnam, which they consider a good investment assets compared to prices in developed markets.

Harry Nguyen from Australia bought a 100-square-meter apartment in Da Nang City last December for just over VND3 billion ($122,000), which he said was a "sound" investment.

"The same apartment would have cost me around $1.5 million in Hong Kong, $400,000 in Australia and $300,000 in the Philippines," he said, adding that he could either live in the property or lease it for around VND30 million a month.

Hung Trinh, who lives in Singapore, said that he and many overseas Vietnamese he knows in Singapore are very interested in Vietnam’s property market, especially now that prices have eased.

"Middle-age people like me need to starting thinking about a place to rest [when we retire]. I have chosen Nha Trang and am investing in a property there," he said, referring to the famous beach city in south-central Vietnam.

Harry and Hung are among around 4 million foreigners and overseas Vietnamese who are looking to buy property in Vietnam for both residential and investment purposes, according to the Ministry of Construction.

A recent survey by property consultancy CBRE showed that Vietnam’s property market ranked second behind India in terms of attractiveness in the Asia Pacific region.

Many foreigners are looking to buy discounted assets, implying that they have a long-term vision of the potential of Vietnam’s economy and the recovery of the property market, said Nguyen Pham Anh Duy, director of investment consultancy at CBRE Vietnam.

Duan Nguyen, a property broker, said that in recent years an increasing number of foreign Vietnamese have been looking to buy houses and villas in the high-end segment.

"Many foreigners ask their family members to make purchases on their behalf. Usually they buy villas at VND15 billion or higher."

He estimated that 15% of his customers are overseas Vietnamese. As villa prices are around 20% lower than their previous peak, foreigners are buying them up quickly.

"They often look in the high-end segment for investment opportunity. Even if they cannot sell the assets for profit later they can still use it as their retirement home."

Alvin Ong, CEO of Hutton, a property brokerage in Singapore, said that whenever a new project is up for sale, around 20-30% of his customers are overseas Vietnamese. Many of them have inquired about projects in Vietnam recently as prices conintue to fall, he said.

In Singapore, taxes can reach up to 65% of a home, which is why many overseas Vietnamese look for potential investment in Vietnam where prices are much lower, he added.

There are around 5.5 million overseas Vietnamese, and many of them want to spend the last years of their lives in Vietnam, which means they are generating demand for property here, said Peter Hong, deputy chairman of the Business Association of Overseas Vietnamese.

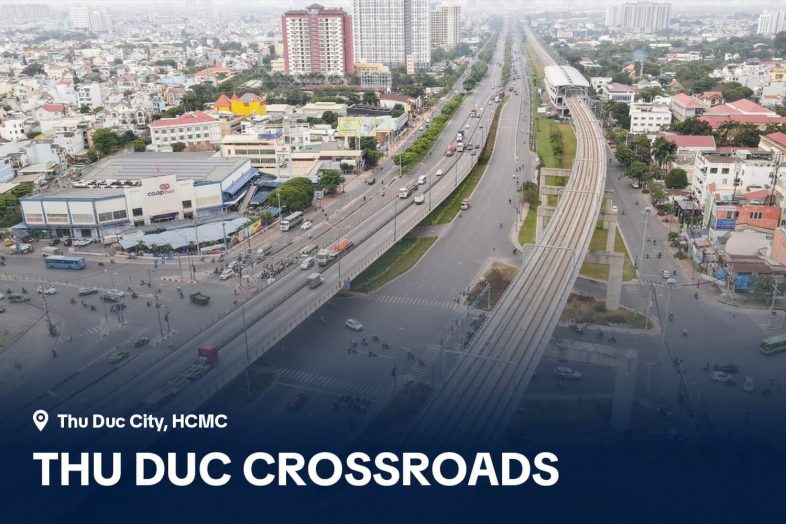

A survey by the Ho Chi Minh City Real Estate Club showed that 3 million overseas Vietnamese want to own property in Vietnam when they return to the country, and most of them want to live in Ho Chi Minh City."

Ngo Thanh Huan, CEO of asset consultancy and management FIDT, said that when foreigners spend the money they gain overseas on Vietnamese property, the local economy gains.

However, they need to be cautious about property prices in Vietnam as they vary greatly, and it takes time to evaluate a property’s true value, he added.

Source: VnExpress